In previous articles, we have advanced the idea that the growth of a radio company comes down to the interaction of two metrics. First, how deep a revenue hole has the attrition of the Key Account Portfolio created? Second, how much new revenue has been produced from New Key Accounts during the current year?

Every time we have analyzed how a radio company has grown its revenue over the prior year, we come across the same two numbers. Either they kept the attrition of their Key Account Portfolio under 13% or they created a large number of New Key Accounts, or both.

However, the impact of the attrition of the Key Account Portfolio is so overwhelming, that we felt we needed to spend more time discussing why Key Account Portfolios are shrinking and what can be done about it.

It’s June 10. Do You Know Where Your Key Account Portfolio Is?

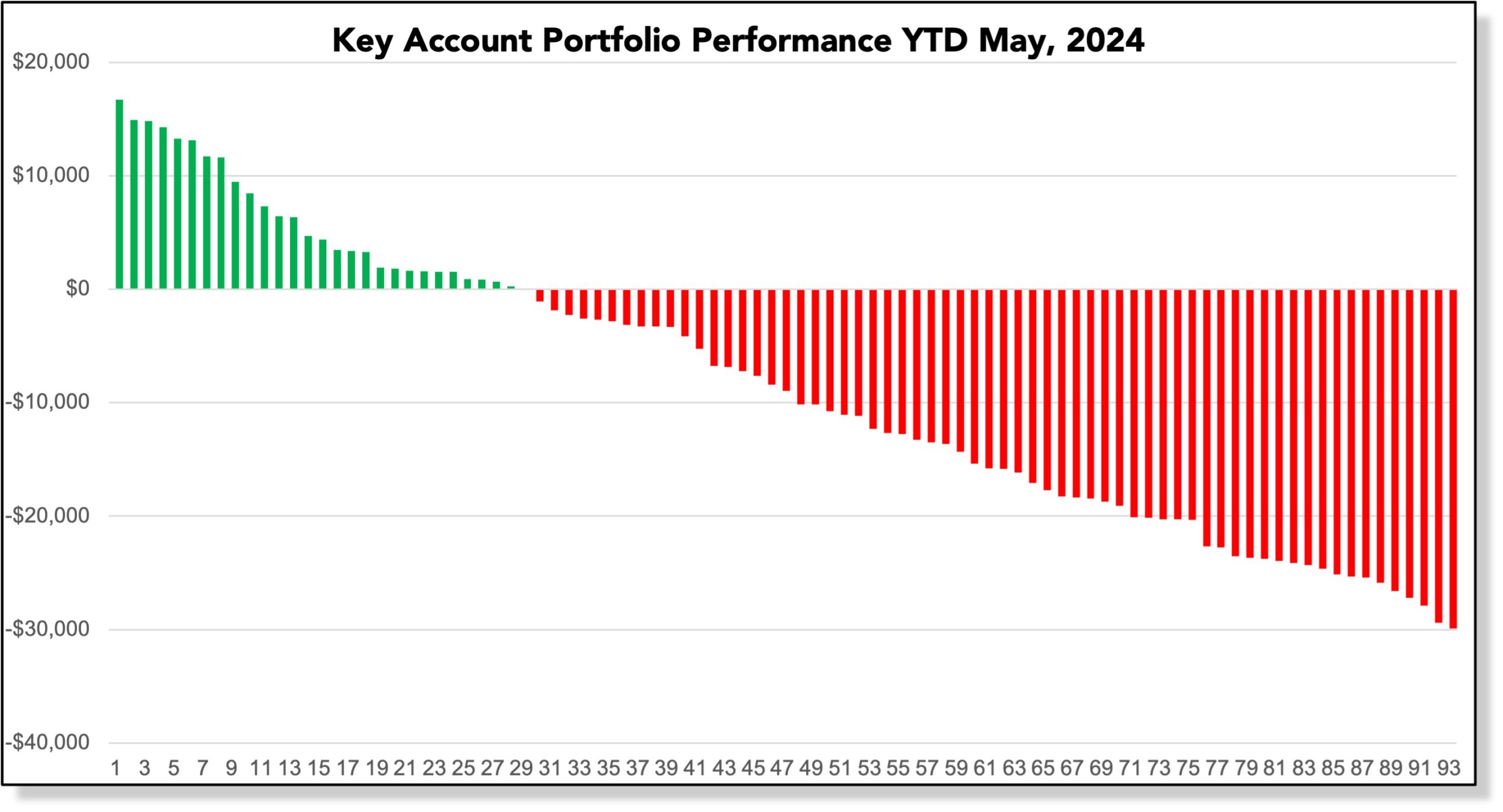

Below is a graph of a radio cluster’s Key Account Portfolio at the end of May. The cluster had 372 active clients in 2023, therefore, their 2024 Key Account Portfolio contains 93 Key Accounts. Of those, 28 have grown, 1 has stayed flat, and 64 have reduced their spending from last year, resulting in year-to-date KAP attrition of 22%.

Unless this situation is corrected, this cluster has no chance of growing this year.

Before we can begin to solve this problem, we must ask the simple question, Does the CEO of this company know that this cluster’s Key Account Portfolio has already lost almost a fourth of its value? And, if not, why not?

It Starts At The Top

There is still time to reduce the total attrition of the KAP. But solving this problem will require an intentional re-focusing of the company’s go-to-market strategy. Such refocusing can only happen if the top leadership of the company – from the CEO on down – takes complete ownership of the KAP and makes the preservation of those important clients a top priority for the Sales Managers.

Make KAP Attrition Important

Every corporate leadership team looks at performance numbers for each of their clusters on a regular basis. It may be ratings information, Miller Kaplan market share, sales of digital products, etc. None of those numbers is anywhere near as important as the attrition experienced by each cluster’s most valuable clients.

So, our first recommendation for any leadership team that is serious about regaining control over their growth is to look at each cluster’s KAP number every month.

Set Rational KAP Attrition Goals

Peter Drucker said that you can’t improve what you don’t measure. As soon as the CEO begins to look at KAP numbers on a regular basis, the obvious next step will be to want to improve them. And, especially knowing that there is a natural threshold of 13% beyond which growth becomes impossible, if a market’s attrition is at 22%, no self-respecting CEO would miss the opportunity to ask the simple question, How do we reduce that to below 13%?

Monitor Progress

Every company has information systems that provide everyone in the organization the data they need to run their individual patches.

The performance of the Key Account Portfolios should be one of the pieces of information that everyone can look at. The Executive Leaders should have a view into all the clusters. The Regional Vice Presidents should have a view into the markets they are responsible for. The Market Managers and sales leaders should be able to see their KAPs and those of their individual sellers.

If the company is serious about using the KAP attrition as a lever for growth, everyone should be able to monitor the portions they are responsible for.

Make it the Sales Managers’ Top Job

Which brings us to the Sales Managers.

The radio business is populated by smart, highly talented, hard-working managers who want their teams to succeed. What smart, talented, hard-working people do in the absence of clear direction from above is they do whatever they think is right. It has been our observation that a company can have as many go-to-market strategies as they have Sales Managers. While such freedom can engender innovation, it can also be very costly in not all sales leaders are pulling in the exact same direction.

Put It In Their Paycheck

We left this crucial piece of the puzzle for the end because it is unlikely that any company will start to rethink its compensation system in the middle of the year. But there is certainly time before 2025 to rethink how to pay people at all levels to focus on the number that matters most to the company’s growth.

We recognize that, for a variety of reasons, Key Accounts are difficult to influence. Even if we set aside the national Key Accounts, getting access to large local clients can be challenging. They are often represented by large advertising agencies, and on the client side, there can be many layers of decision-makers to contend with. So, we empathize when a Sales Manager cautions that we should be careful not to make it sound easier than it really is.

That said, we have plenty of data that shows that the performance of Key Accounts – especially in the aggregate – can be influenced. No radio company needs to accept high Key Account attrition as a normal cost of doing business.